The hoax of cool in Michigan’s emerald city detailed in ‘Broke’

COURTESY

Posted Thursday, December 12, 2019 11:23 amBill Castanier

In the late ’70s, while I worked for the State of Michigan’s Department of Labor, a researcher-futurist completed a report that concluded Detroit had become the victim of what he called “economic apartheid.” In the report, he compared the economy of southeast Detroit to a doughnut with Detroit the hole in the middle. It was thought too controversial to release and it sits somewhere in the Library of Michigan or the State Archives.

“Broke” can mean a couple of different things, as in someone who is penniless, or it can mean something that doesn’t work.

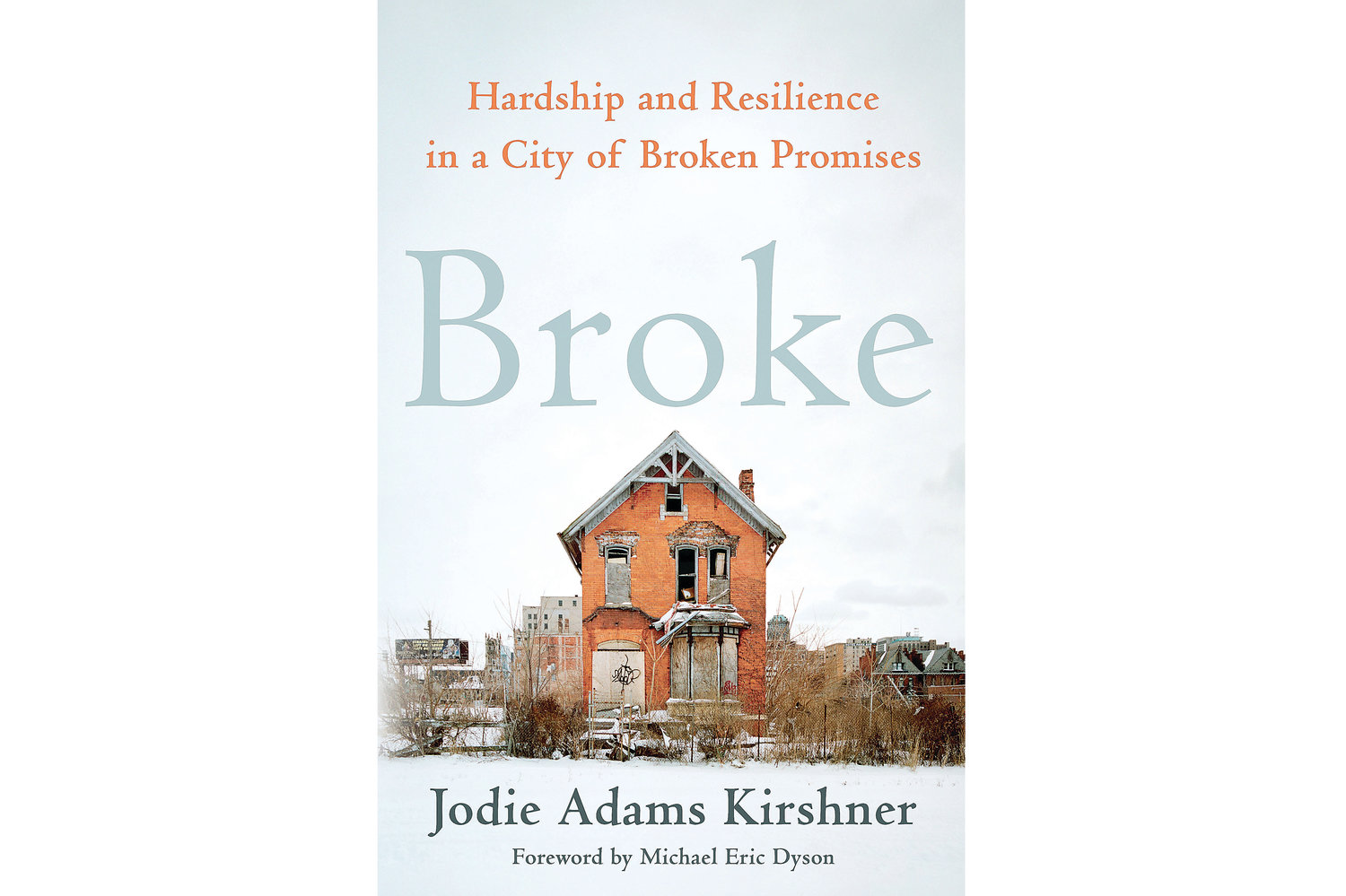

In her new book, “Broke: Hardship and Resilience in a City of Broken Promises,” Jodie Adams Kirshner deftly explores both definitions when discussing the aftermath of Detroit’s 2013 bankruptcy and its daily impact on residents.

The narrative follows seven residents who are representative of the city’s population and what happened to them after bankruptcy. Through their stories, Kirshner keeps a keen eye on a mortgage and foreclosure system that is broke and not working for its residents.

Kirshner is a research professor at New York University and previously on the law faculty at Cambridge University. She also teaches bankruptcy law at Columbia Law School in New York City. Her multiyear research was funded by the Kresge Foundation.

She followed the Detroit bankruptcy closely and believes it helped the city clean up its balance sheet, but did little to alleviate the problems that people who live there are facing.

At the time, Detroit was the largest municipality to seek bankruptcy protection. Following bankruptcy, sections of Detroit were rebounding, fueled by developers like Dan Gilbert, billionaire co-founder of Quicken Loans and Rock Ventures who has bought and restored nearly 100 buildings in the city.

One measure that Kirshner cites of a city still struggling is from 2005 to 2015, 100,000 homeowners became renters due to foreclosure. Kirshner noted the city at one time had the highest rate of home ownership in the country during the mid 20th century.

Most of these foreclosures were due to predatory subprime mortgages. In Detroit in 2005, 70% of new mortgages qualified as subprime.

A recent article in the Wall Street Journal proclaimed “Bonds Backed by Rentals Bolster Landlords, Flippers.” It pointed out that since 2018, 11% of all homes were purchased by landlords and flippers buying foreclosed homes to “turn into rentals.”

“At the time of the bankruptcy I was a real advocate of the process, but I wanted to tell the story of those who were caught up in it and what bankruptcy can’t do,” she said. “I started with the real estate story and the challenges before and after bankruptcy,” Kirshner said.

Included in the mix of the seven individuals Kirshner followed are Lola, an African-American who makes a two-hour commute to work at a call center in the suburbs. There is Miles, an African-American construction worker, who despite a building boom can’t find work. Cindy, a white community activist, is depicted as a woman who works diligently to improve the neighborhood. Lastly, the book follows Reggie, who put all his money in his home, and Robin, a white property developer from Los Angeles, who buys foreclosed homes and rents them as a get-rich-quick scheme.

As an outsider, it’s easy to be judgmental about the difficult situations facing these people, but they work hard despite it all to hold on to the American Dream which includes a home of their own.

Kirshner provides adequate examples of what’s wrong with the broke foreclosure system. In 2008, banks foreclosed on 37,000 properties in Detroit with half of them selling for less than $10,000 at auction. In another situation, the author cites statistics pointing to the Detroit Land Bank Authority, which owns more than 100,000 properties, becoming by default a landlord with lacking expertise. Perhaps the most egregious is the bundling of foreclosed properties which are then sold to one bidder, preventing individuals from buying a home, sometimes the one they are living in.

Kirshner is best when she describes the seemingly mundane auto insurance with a rating system that is skewed against Detroit residents. Miles is caught driving with fraudulent insurance (not his fault) and is thrown in to the court system. Even the tow truckdriver rips him off, and something called driver responsibility fees are assessed which he cannot pay. Without a car he can’t work. His troubles just cascade.

In her book, Kirshner writes “On the one hand, the name Detroit has increasingly become synonymous with grit and cool. On the other hand, the rising fortunes of greater downtown have seemed to do little to help the majority of the city and its remaining residents.”

“Many in Detroit like Charles, Reggie, Joe, Cindy and Miles have not felt their life-improving and, in some cases, they have felt it getting worse,” Kirshner wrote.

In Kirshner’s words, the issue that led to the crumbling market is “we had overlooked urban residents and considered the issues in the wrong way.”